June had recorded rainfall of 87 percent of the Long Period Average, which was deficient, casting fear of drought like situation

June had recorded rainfall of 87 percent of the Long Period Average, which was deficient, casting fear of drought like situationfrom Moneycontrol Latest News https://ift.tt/2ZrqrSM

UBP Smart Gurukul is a Channel for all those people who are willing to earn money online From Stock Market, Bitcoin, MLM Company, Online Earning Apps and Websites. I am working online from last 10 years now and have good enough experience in nearly all fields of online money making methods . So with help of my blog i would like to help more and more people to make money online! So subscribe my blog as you will get lot of earning tips on UBP Smart Gurukul that will help you to earn money Online.

June had recorded rainfall of 87 percent of the Long Period Average, which was deficient, casting fear of drought like situation

June had recorded rainfall of 87 percent of the Long Period Average, which was deficient, casting fear of drought like situation On the second of back-to-back nights of Democratic debates, front-runner Joe Biden was flanked at centre stage by rivals Kamala Harris and Cory Booker, U.S. senators who are the most prominent black contenders in a Democratic nominating contest in which race has played a prominent role.

On the second of back-to-back nights of Democratic debates, front-runner Joe Biden was flanked at centre stage by rivals Kamala Harris and Cory Booker, U.S. senators who are the most prominent black contenders in a Democratic nominating contest in which race has played a prominent role. His aggressive tactics on trade, including 25% tariffs on $200 billion of Chinese goods that prompted retaliatory duties on U.S. exports, have made companies uncertain about the future and more hesitant to invest.

His aggressive tactics on trade, including 25% tariffs on $200 billion of Chinese goods that prompted retaliatory duties on U.S. exports, have made companies uncertain about the future and more hesitant to invest. "The firing of these missiles don#39;t violate the pledge that Kim Jong Un made to the president about intercontinental-range ballistic missiles," Bolton said in an interview on Fox Business Network.

"The firing of these missiles don#39;t violate the pledge that Kim Jong Un made to the president about intercontinental-range ballistic missiles," Bolton said in an interview on Fox Business Network. Eicher Motors | Wipro | Ashok Leyland | IndiaMart InterMesh | Unichem Labs and Ajanta Pharma are stocks which are in the news today.

Eicher Motors | Wipro | Ashok Leyland | IndiaMart InterMesh | Unichem Labs and Ajanta Pharma are stocks which are in the news today. On the higher end, 11,300 will act as a crucial resistance. Going forward, sustained trades above 11,300 may further fuel the rally towards 11,450

On the higher end, 11,300 will act as a crucial resistance. Going forward, sustained trades above 11,300 may further fuel the rally towards 11,450 The banks use different names -Citi calls this its "base rate," and JPMorgan refers to a "prime rate." However, lowering this benchmark rate means lower interest rates on loans that are based off the Fed#39;s main short-term rate. The move could result in lower revenues for the banks in the coming quarters.

The banks use different names -Citi calls this its "base rate," and JPMorgan refers to a "prime rate." However, lowering this benchmark rate means lower interest rates on loans that are based off the Fed#39;s main short-term rate. The move could result in lower revenues for the banks in the coming quarters. It said Trump and the first lady "will attend commemorative ceremonies and visit memorial sites in Warsaw on September 1, 2019, on the occasion of the 80th anniversary of the beginning of World War II."

It said Trump and the first lady "will attend commemorative ceremonies and visit memorial sites in Warsaw on September 1, 2019, on the occasion of the 80th anniversary of the beginning of World War II." Japan#39;s Nikkei also fell 0.4%. South Korea#39;s KOSPI slipped 0.5% while Australian shares declined 0.3%.

Japan#39;s Nikkei also fell 0.4%. South Korea#39;s KOSPI slipped 0.5% while Australian shares declined 0.3%. The Dow Jones Industrial Average fell 333.75 points, or 1.23%, to 26,864.27, the SP 500 lost 32.8 points, or 1.09%, to 2,980.38 and the Nasdaq Composite dropped 98.20 points, or 1.19%, to 8,175.42.

The Dow Jones Industrial Average fell 333.75 points, or 1.23%, to 26,864.27, the SP 500 lost 32.8 points, or 1.09%, to 2,980.38 and the Nasdaq Composite dropped 98.20 points, or 1.19%, to 8,175.42. Trends on SGX Nifty indicate a negative opening for the broader index in India, a with 0.39 percent loss or 43 points.

Trends on SGX Nifty indicate a negative opening for the broader index in India, a with 0.39 percent loss or 43 points. Eicher Motors | Wipro | Ashok Leyland | IndiaMart InterMesh | Unichem Labs and Ajanta Pharma are stocks which are in the news today.

Eicher Motors | Wipro | Ashok Leyland | IndiaMart InterMesh | Unichem Labs and Ajanta Pharma are stocks which are in the news today. Japan#39;s Nikkei also fell 0.4%. South Korea#39;s KOSPI slipped 0.5% while Australian shares declined 0.3%.

Japan#39;s Nikkei also fell 0.4%. South Korea#39;s KOSPI slipped 0.5% while Australian shares declined 0.3%. Fed Chairman Powell cited global weakness, simmering trade tensions and a desire to boost too-low inflation in explaining the central bank#39;s decision to lower borrowing costs

Fed Chairman Powell cited global weakness, simmering trade tensions and a desire to boost too-low inflation in explaining the central bank#39;s decision to lower borrowing costs The Dow Jones Industrial Average fell 333.75 points, or 1.23%, to 26,864.27, the SP 500 lost 32.8 points, or 1.09%, to 2,980.38 and the Nasdaq Composite dropped 98.20 points, or 1.19%, to 8,175.42.

The Dow Jones Industrial Average fell 333.75 points, or 1.23%, to 26,864.27, the SP 500 lost 32.8 points, or 1.09%, to 2,980.38 and the Nasdaq Composite dropped 98.20 points, or 1.19%, to 8,175.42. 53 companies will declare their results for June quarter which include names like Bharti Airtel, CEAT, Godrej Consumer, HCC, ICRA, JK Tyre, Marico and Raymond among others.

53 companies will declare their results for June quarter which include names like Bharti Airtel, CEAT, Godrej Consumer, HCC, ICRA, JK Tyre, Marico and Raymond among others.

The NBA has partnered with the crypto collectibles developer behind CryptoKitties to launch a new collectibles platform and competitive game

July was yet another strong month for the stock markets despite looming threat of a coming economic recession, with the Dow, Nasdaq, and S&P 500 all close to beating out their average monthly gains for the calendar month. Bitcoin, however, has spent much of July locked in a downtrend.

This morning as the Fed monetary policy meeting met its deadline to cut rates, the Dow Jones Industrial Average dropped sharply over the news. Around the same time, Bitcoin spiked above its local lows and could be signaling a bullish reversal is around the corner. As the two markets respond to the news, what’s next for each?

Today, the Federal Open Market Committee lowered the lending rate by 25 basis points. Worried stock market investors had begun the selloff late Tuesday into Wednesday, resulting in as much as a 450 point drop for the Dow following the announcement from Federal Reserve Chairman Jerome Powell.

Related Reading | Bitcoin Rises as Markets Expect Decade’s First Fed Rate Cut

Powell called the cut a “mid-cycle adjustment to policy,” and says that it’s “not the beginning of a long series of rate cuts.” But stock market investors were shaken regardless, resulting in the steep decline.

United States President Donald Trump had called for a cut of 50 basis points, so despite the reaction, Powell’s cut is modest by comparison.

Looming concerns surrounding the US and China trade war has only further fueled investor anxiety fearing the rate cut is just another ingredient in a recipe for economic disaster. During economic downturns, investors often sell off their stocks in exchange for “safe haven” assets and could be what is driving the selloff in the stock market.

While stock market investors de-risk and separate themselves from US-driven stocks and indices, the outflow of capital typically goes somewhere. In the past, as economic turmoil heats up, so does the price of gold, and safe-haven currencies such as the Swiss franc or Japanese yen.

Related Reading | Prominent Investor: Mainstream Finance Is Now Considering Bitcoin As a Safe Haven Asset

In recent weeks, gold has captured media attention for kickstarting what many believe to be a bull run for the precious metal and investment asset. Gold’s scarcity and longevity make it a top choice during economic downtrends as a way to hedge against further decline. Both Bitcoin and gold have been showing correlated price movements.

Bitcoin was designed in the wake of the 2009 financial crisis and just experienced the first-ever federal rate cut since it existed. How it reacts from here is anyone’s guess. The crypto asset recently left its bear market lows and has risen alongside gold. Bitcoin is pitched as the digital version of gold, sharing many similarities.

Bitcoin, in the face of economic downturn, may finally show its true potential as a digital replacement for gold, and as the economic hedge creator, Satoshi Nakamoto had designed it to be. And as capital flees falling stock markets, Bitcoin very well could continue on its bull run from here and become the global currency replacement for fiat that many envision it to be.

The post Dow Jones Drops After Fed Rate Cut, What’s This Mean for Bitcoin? appeared first on NewsBTC.

An Arizona startup is testing its stablecoin payments platform for the medical marijuana industry through the state’s fintech sandbox

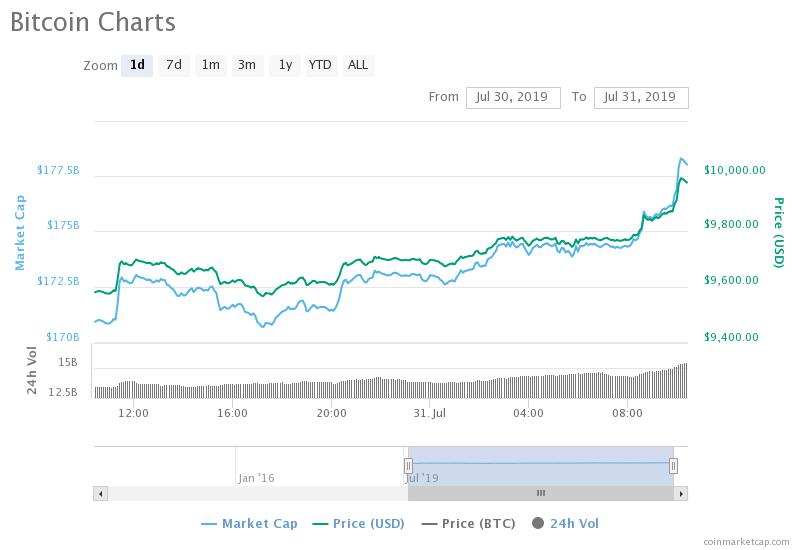

Bitcoin (BTC) and the aggregated crypto markets incurred a sudden influx of buying pressure yesterday that allowed them to climb significantly higher. This upwards momentum came about after a long period of downwards pressure that had jeopardized the upwards momentum that the markets had incurred throughout the first half of 2019.

Analysts are now noting that this latest movement that sent Bitcoin past $10,000 has led to a massive shift in market sentiment, which could prove to be a negative thing for the crypto markets that ultimately results in a continuation of the recently incurred sell off.

At the time of writing, Bitcoin is trading up nearly 4% at its current price of $10,035 and is up significantly from daily lows of just over $9,500.

This price surge came about after a long period of selling pressure that was first started in late-June when Bitcoin failed to break above $13,800 and was perpetuated earlier this month when BTC rapidly surged to $11,000 before facing a swift rejection that sent it reeling down.

Analysts are now noting that this latest price surge has added some technical strength to the cryptocurrency, but they are also warning that there may be another minor pullback before BTC solidifies its position within the five-figure price region.

“$BTC update: [Target] hit. I’m still bullish but it makes a lot of sense to take some off here and wait for the daily to close at 10300+. If it doesn’t I’d close the trade anyway. Trading when sentiment shifts from one extreme to the other is my favorite way to trade,” DonAlt explained while referencing resistance on the below chart.

$BTC update:

hit

I'm still bullish but it makes a lot of sense to take some off here and wait for the daily to close at 10300+

If it doesn't I'd close the trade anyway.Trading when sentiment shifts from one extreme to the other is my favorite way to trade. pic.twitter.com/uUxD66FEop

— DonAlt (@CryptoDonAlt) July 31, 2019

Although the general market sentiment was fairly bearish before this movement, with many analysts anticipating a movement to $8,800, analysts are now noting that this newfound bullishness that came about after Bitcoin’s move above $10,000 could be a trap.

“With the longer trend in mind, the test of the upper range should be read as ‘bait and switches’. The get people bullish again [revival of FOMO] and then… the predictable. The psychology is one of anxiety,” Dave The Wave, a cryptocurrency analyst, warned in a recent tweet.

With the longer trend in mind, the test of the upper range should be read as 'bait and switches'. The get people bullish again [revival of FOMO] and then….. the predictable. The psychology is one of anxiety.

— dave the wave (@davthewave) July 31, 2019

As the week continues on and as analysts gain greater insight into whether or not this latest price surge is sustainable, it is highly probable that it will grow clearer as to whether or not Bitcoin will trade bullishly or bearishly in the near-future.

Featured image from Shutterstock.

The post Market Sentiment Swings as Bitcoin Taps $10,000, But Strong Resistance Remains Ahead appeared first on NewsBTC.

Bears are likely to keep control over the markets and the current trend is likely to remain under pressure with Nifty moving towards 11,000-10,900 levels.

Bears are likely to keep control over the markets and the current trend is likely to remain under pressure with Nifty moving towards 11,000-10,900 levels. Live updates: Cafe Coffee Day founder VG Siddhartha#39;s body has been found near Mangaluru. He was missing since July 29

Live updates: Cafe Coffee Day founder VG Siddhartha#39;s body has been found near Mangaluru. He was missing since July 29 Live updates: Cafe Coffee Day founder VG Siddhartha#39;s body has been found near Mangaluru. He was missing since July 29

Live updates: Cafe Coffee Day founder VG Siddhartha#39;s body has been found near Mangaluru. He was missing since July 29 Almost 90 percent of suicides can be prevented by timely intervention, say experts

Almost 90 percent of suicides can be prevented by timely intervention, say experts In Bihar 88.46 lakh people have been affected in 13 districts in inundation caused earlier this month due to the torrential rainfall in the catchment areas of Nepal, state disaster management department said.

In Bihar 88.46 lakh people have been affected in 13 districts in inundation caused earlier this month due to the torrential rainfall in the catchment areas of Nepal, state disaster management department said. The latest launches were from the Hodo peninsula on North Korea#39;s east coast, the same area from where last week#39;s were conducted, South Korea#39;s Joint Chiefs of Staff (JCS) said in a statement. It said it was monitoring in case of additional launches.

The latest launches were from the Hodo peninsula on North Korea#39;s east coast, the same area from where last week#39;s were conducted, South Korea#39;s Joint Chiefs of Staff (JCS) said in a statement. It said it was monitoring in case of additional launches. The incident was recounted on Monday by Jodhpur airbase Air Officer-in-Command Phillip Thomas to the district administration, which is responsible for the upkeep of the open portion of a drain outside the military aerodrome, the source of the problem.

The incident was recounted on Monday by Jodhpur airbase Air Officer-in-Command Phillip Thomas to the district administration, which is responsible for the upkeep of the open portion of a drain outside the military aerodrome, the source of the problem. The BJP#39;s central leadership, including working president J P Nadda, on Tuesday held a meeting with its Jammu and Kashmir leaders.

The BJP#39;s central leadership, including working president J P Nadda, on Tuesday held a meeting with its Jammu and Kashmir leaders. MSCI#39;s broadest index of Asia-Pacific shares outside Japan was down 0.04% while Japan#39;s Nikkei slid 0.84%.

MSCI#39;s broadest index of Asia-Pacific shares outside Japan was down 0.04% while Japan#39;s Nikkei slid 0.84%. The Dow Jones Industrial Average fell 23.33 points, or 0.09%, to 27,198.02, the SP 500 lost 7.79 points, or 0.26%, to 3,013.18he Nasdaq Composite dropped 19.72 points, or 0.24%, to 8,273.61.

The Dow Jones Industrial Average fell 23.33 points, or 0.09%, to 27,198.02, the SP 500 lost 7.79 points, or 0.26%, to 3,013.18he Nasdaq Composite dropped 19.72 points, or 0.24%, to 8,273.61. Tech Mahindra | DHFL | JSW Steel | Gujarat Gas | Alkem Labs | Dish TV | Shoppers Stop and Vinati Organics are stocks which are in the news today.

Tech Mahindra | DHFL | JSW Steel | Gujarat Gas | Alkem Labs | Dish TV | Shoppers Stop and Vinati Organics are stocks which are in the news today. Trends on SGX Nifty indicate a negative opening for the broader index in India, a with 0.3 percent loss or 33.5 points.

Trends on SGX Nifty indicate a negative opening for the broader index in India, a with 0.3 percent loss or 33.5 points. MSCI#39;s broadest index of Asia-Pacific shares outside Japan was down 0.04% while Japan#39;s Nikkei slid 0.84%.

MSCI#39;s broadest index of Asia-Pacific shares outside Japan was down 0.04% while Japan#39;s Nikkei slid 0.84%. The Dow Jones Industrial Average fell 23.33 points, or 0.09%, to 27,198.02, the SP 500 lost 7.79 points, or 0.26%, to 3,013.18he Nasdaq Composite dropped 19.72 points, or 0.24%, to 8,273.61.

The Dow Jones Industrial Average fell 23.33 points, or 0.09%, to 27,198.02, the SP 500 lost 7.79 points, or 0.26%, to 3,013.18he Nasdaq Composite dropped 19.72 points, or 0.24%, to 8,273.61. As many as 89 companies will declare their results for the June quarter which include names like Allahabad Bank, Apollo Tyres, Eicher Motors, Tata Global Beverages, Petronet LNG, MOSL, JBF Industries, IOC, Future Retail among others.

As many as 89 companies will declare their results for the June quarter which include names like Allahabad Bank, Apollo Tyres, Eicher Motors, Tata Global Beverages, Petronet LNG, MOSL, JBF Industries, IOC, Future Retail among others.Crypto was designed to eventually serve as a complete replacement for fiat currencies like the US dollar as the entire world moves into a fully digital age, so money itself can more easily and quickly be managed without the requirement of a third-party intermediary.

But it wasn’t until Facebook, one of the largest and most powerful corporations in the entire world, announced their plans to launch a crypto asset called Libra that was designed as a 1:1 replacement for the dollar and other fiat currencies that US regulators began to take a defensive and potentially reactive stance against crypto, Bitcoin, and Facebook Libra itself. And now, as that controversy heats up, Ripple is siding with US regulators, saying that a “new fiat currency” isn’t needed and that the dollar is perfectly suitable – an even makes negative comments towards Bitcoin and Ethereum in an attempt to distance his company from the rest of the crypto space and divert the attention towards the competition.

Following weeks of controversy surrounding Facebook Libra, fears over the corporation becoming too powerful when privacy is an issue, and concerns over what it could mean for the US dollar, the once bullish crypto market has begun to take caution that stiff regulation may be ahead.

Related Reading | The United States’ Distrust in Facebook Libra Is Spilling Into Crypto

During a recent conversation on Bloomberg TV regarding the much-discussed, hot-button financial and technology topic, Ripple CEO Brad Garlinghouse lashed out at Facebook Libra, Bitcoin, and Ethereum, and took every step possible to align with chief financial regulators in the US and divert negative attention away from his company’s native crypto token, XRP.

"I think the U.S. dollar works pretty well. We don't need a new fiat currency"– Ripple CEO Brad Garlinghouse on why he thinks Facebook took an arrogant approach with Librahttps://t.co/faVtrXTMej pic.twitter.com/aAs8YyyiEU

— Bloomberg TV (@BloombergTV) July 29, 2019

Garlinghouse first claims that while Facebook’s efforts are “ambitious,” but also “arrogant” for trying to replace fiat currency. “We don’t need a new fiat currency,” he added.

“Financial regulation matters. Know your customer and anti-money laundering, and anti-terrorist financing… these are important foundational pieces of our financial system, and we need to make sure that the future constructs keep that in mind,” Garlinghouse told Bloomberg.

He worries that “legitimate projects working on taking advantage of crypto to solve real problems get caught in the” US government versus Facebook crossfire, and says President Donald Trump’s blanket statement that all cryptocurrencies are bad is akin to not liking an internet company in 1997, suggesting that the industry is young, will mature and change, and many of the early, hype-driven projects will fizzle out long before crypto is widely adopted.

Garlinghouse hoping to play nice with financial regulators in their home country of the United States, makes perfect sense, especially in response to Libra being major competition for the brand. The segment host even comments on how Facebook’s Libra crypto asset is in opposition to XRP, Ripple’s native token.

Related Reading | SWIFT Approaching Ripple (XRP) Speeds In Latest Cross-Border Payment Trial

Rather than stopping with Libra, the Ripple CEO also took jabs at Bitcoin and Ethereum, and strategically pushing buttons of US regulators that may be watching. He says that Ripple is working “with banks, with regulators,” unlike Bitcoin and Ethereum that are “controlled by Chinese miners.”

In the end, the CEO is protecting his brand, product, and investors by attacking Bitcoin and Ethereum, and fueling additional concerns around Libra, Garlinghouse will need to be careful not to drag the entire crypto industry through the mud while he does so, or risk tarnishing his own brand in the process.

The post Ripple Sides With US Regulators on Crypto Controversy and Facebook Libra appeared first on NewsBTC.

Bitcoin and the aggregated crypto markets have been facing a bout of choppy trading as of late that has led BTC’s price into a key trading range that will likely set the tone for which direction the crypto trends in the coming days and weeks.

At the same time, it is also important to note that Bitcoin’s fundamentals appear to be building strength, as the cryptocurrency’s hashrate has now reached a fresh all-time-high, which may correlate with positive price action in the immediate future.

At the time of writing, Bitcoin is trading up just over 1% at its current price of $9,670, which is up significantly from its daily lows of $9,400 that were set yesterday.

While zooming out and looking at Bitcoin’s weekly price action, it appears that is has formed a wide trading range between roughly $10,200 and $9,200, with resistance at the former price and support at the latter.

Over a shorter time frame, BTC has been trading between $9,400 and $9,700, which appears to be a critical price range that will likely determine the future of where BTC heads next.

DonAlt, a popular cryptocurrency analyst on Twitter, spoke about the importance of where Bitcoin goes next, noting that he does believe it is more likely that BTC moves higher in the near-future, with an upwards target existing around $10,000.

“$BTC: The current range won’t hold for much longer. Once it breaks, I expect violence. Place your bets & stops carefully and enjoy the ride. I’m personally betting on a break upwards because longs offer better R:R at support but I could see this go either way,” he explained.

The current range won't hold for much longer.

Once it breaks, I expect violence.

Place your bets & stops carefully and enjoy the ride.I'm personally betting on a break upwards because longs offer better R:R at support but I could see this go either way. pic.twitter.com/qzLvkAlair

— DonAlt (@CryptoDonAlt) July 30, 2019

Many analysts and investors look towards Bitcoin’s hashrate as a sign of its fundamental strength, as it is a convenient way to comprehensively understand how much BTC is being utilized.

Hodlonaut, a popular figure within the cryptocurrency industry, spoke about the fact that Bitcoin’s hashrate has set a fresh all-time-high in a recent tweet, saying:

“Sorry for being a broken record. But Bitcoin did set yet another hashrate ATH yesterday.”

Sorry for being a broken record..

But Bitcoin did set yet another hashrate ATH yesterday. pic.twitter.com/q08tL1THD3

— hodlonaut

(@hodlonaut) July 30, 2019

Although it is unclear presently as to whether or not this bullish fundamental factor will be enough to propel Bitcoin’s price higher, whether or not its price breaks upwards or downwards in the near-future will likely determine how the crypto markets trend in the near-future.

Featured image from Shutterstock.

The post Bitcoin Price Nears Key Decision Point as Hashrate Surges to Fresh All-Time-Highs appeared first on NewsBTC.

The suspect, a 33-year-old former Seattle technology company software engineer identified as Paige Thompson, made her initial appearance in U.S. District Court in Seattle on Monday, the U.S. Attorney#39;s office said.

The suspect, a 33-year-old former Seattle technology company software engineer identified as Paige Thompson, made her initial appearance in U.S. District Court in Seattle on Monday, the U.S. Attorney#39;s office said. South Korea#39;s KOSPI advanced 0.2% and Japan#39;s Nikkei added 0.7%. Australian stocks climbed as much as 0.7% to touch a record high, supported by buoyant mining shares and adding to the previous day#39;s tech-driven gains.

South Korea#39;s KOSPI advanced 0.2% and Japan#39;s Nikkei added 0.7%. Australian stocks climbed as much as 0.7% to touch a record high, supported by buoyant mining shares and adding to the previous day#39;s tech-driven gains. The Dow Jones Industrial Average rose 28.9 points, or 0.11%, to 27,221.35, the SP 500 lost 4.89 points, or 0.16%, to 3,020.97 and the Nasdaq Composite dropped 36.88 points, or 0.44%, to 8,293.33.

The Dow Jones Industrial Average rose 28.9 points, or 0.11%, to 27,221.35, the SP 500 lost 4.89 points, or 0.16%, to 3,020.97 and the Nasdaq Composite dropped 36.88 points, or 0.44%, to 8,293.33. South Korea#39;s KOSPI advanced 0.2% and Japan#39;s Nikkei added 0.7%. Australian stocks climbed as much as 0.7% to touch a record high, supported by buoyant mining shares and adding to the previous day#39;s tech-driven gains.

South Korea#39;s KOSPI advanced 0.2% and Japan#39;s Nikkei added 0.7%. Australian stocks climbed as much as 0.7% to touch a record high, supported by buoyant mining shares and adding to the previous day#39;s tech-driven gains. The Dow Jones Industrial Average rose 28.9 points, or 0.11%, to 27,221.35, the SP 500 lost 4.89 points, or 0.16%, to 3,020.97 and the Nasdaq Composite dropped 36.88 points, or 0.44%, to 8,293.33.

The Dow Jones Industrial Average rose 28.9 points, or 0.11%, to 27,221.35, the SP 500 lost 4.89 points, or 0.16%, to 3,020.97 and the Nasdaq Composite dropped 36.88 points, or 0.44%, to 8,293.33.