UBP Smart Gurukul is a Channel for all those people who are willing to earn money online From Stock Market, Bitcoin, MLM Company, Online Earning Apps and Websites. I am working online from last 10 years now and have good enough experience in nearly all fields of online money making methods . So with help of my blog i would like to help more and more people to make money online! So subscribe my blog as you will get lot of earning tips on UBP Smart Gurukul that will help you to earn money Online.

Wednesday 31 October 2018

Compromised Crypto Exchange Coincheck Reopens New Account Signups & Limited Trading

from CryptoGlobe latest articles https://ift.tt/2ze1KNW

Litecoin (LTC) Price Analysis – October 30

from CryptoGlobe latest articles https://ift.tt/2OVWPM9

Former US Presidential Candidate Ron Paul Says Cryptocurrencies Should Be Exempt From Taxes

from CryptoGlobe latest articles https://ift.tt/2Ddq7PU

Coinbase Raises $300 Million in New Funding, Aims to Support ‘Thousands’ of Cryptocurrencies in the Future

from CryptoGlobe latest articles https://ift.tt/2Q5sMOE

Bittrex International To Launch Trading Platform in Malta

from CryptoGlobe latest articles https://ift.tt/2Q4sNCr

The Week: Coinbase and Circle, Bitcoin ETF Meeting, UK Financial Taskforce Report

from CryptoGlobe latest articles https://ift.tt/2OYvE37

Ethereum (ETH) Price Analysis – October 30

from CryptoGlobe latest articles https://ift.tt/2zdavb0

Bitcoin (BTC) Price Analysis – October 30

from CryptoGlobe latest articles https://ift.tt/2PwXF1g

UK Financial Taskforce Publishes Report Listing Opportunities and Risks of Crypto Assets

from CryptoGlobe latest articles https://ift.tt/2zgoTiq

Crypto Roundup - 30 October 2018

from CryptoGlobe latest articles https://ift.tt/2RqQCER

CryptoCompare Launches Mobile App for Digital Currencies

from CryptoGlobe latest articles https://ift.tt/2OYGFli

Russian Diamond Mining Giant Alrosa Joins Pilot Program for Blockchain-Powered Diamond Traceability Platform ‘Tracr’

from CryptoGlobe latest articles https://ift.tt/2AA6v6c

SME Funding Platform Investx Plans ‘Ethical’ ICO

from CryptoGlobe latest articles https://ift.tt/2PwKoFS

Does Cryptocurrency Really Have Value?

from CryptoGlobe latest articles https://ift.tt/2RnWdf0

EOS', Ripple's Networks Consume Far Less Energy Than Bitcoin and Ethereum's Blockchain

from CryptoGlobe latest articles https://ift.tt/2JnFndx

Major Singapore-based Utility Corporation Introduces Blockchain-Powered Solar Energy Marketplace

from CryptoGlobe latest articles https://ift.tt/2EPCF1z

Universal EOS-ETH Crosschain Links Achieved With New ‘Teleport’ Method

from CryptoGlobe latest articles https://ift.tt/2qg8NkP

OnePlus 6T Review

from RSS Feeds : RSS REVIEWS Feed - NDTV Gadgets360.com https://ift.tt/2CTHxAv

Diablo 3: Eternal Collection Nintendo Switch Review

from RSS Feeds : RSS REVIEWS Feed - NDTV Gadgets360.com https://ift.tt/2qkCl0K

Lupin Q2 preview: Experts say tepid numbers likely on decline in US business

Resolution of the warning letter at Lupin#39;s Goa and Indore sites is also the key event to watch out for in second half of FY19.

Resolution of the warning letter at Lupin#39;s Goa and Indore sites is also the key event to watch out for in second half of FY19.from Moneycontrol Results News https://ift.tt/2SxHKOU

Take Solutions Consolidated September 2018 Net Sales at Rs 515.88 crore, Up 39.08% Q-o-Q.

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2Dd8CPW

Esab India Standalone September 2018 Net Sales at Rs 166.42 crore, up 31.12% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2JqURx9

Bank of Mah Standalone September 2018 Net Interest Income (NII) at Rs 1,002.86 crore, up 4.13% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2DcQy8B

Symphony Standalone September 2018 Net Sales at Rs 148.00 crore, down 19.67% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2Jw1Xkk

Hind Rectifiers Standalone September 2018 Net Sales at Rs 59.40 crore, up 147.56% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2DbH2Cw

Unichem Labs Standalone September 2018 Net Sales at Rs 245.92 crore, down 42.56% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2Jt0aMy

JK Tyre amp; Ind Standalone September 2018 Net Sales at Rs 1,943.12 crore, up 21.15% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2DeHmR8

BASF Standalone September 2018 Net Sales at Rs 1,675.57 crore, up 15.15% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2JqnH0G

Guj Poly AVX Standalone September 2018 Net Sales at Rs 7.07 crore, up 116.85% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2DbdkxL

Welspun Enter Standalone September 2018 Net Sales at Rs 249.75 crore, up 71.8% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2JqnEC2

Times Guaranty Standalone September 2018 Net Sales at Rs 0.34 crore, down 28.11% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2DhBDdg

Gateway Distri Standalone September 2018 Net Sales at Rs 88.54 crore, up 10.42% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2Q4NbTX

ABB India Standalone September 2018 Net Sales at Rs 2,515.36 crore, up 31.33% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2qktIUb

Shree Digvijay Standalone September 2018 Net Sales at Rs 95.27 crore, up 0.38% Q-o-Q

NULL

NULLfrom Moneycontrol Results News https://ift.tt/2Q9jNvY

SAFE Crossroads #45, Approaches to Alpha 3, with Nikita Baksalyar

In this episode we catch up on some of the things that have been going on in SAFE Network development, where it's been and what's coming down the line now, including the roll out of public testing of the automated peer-to-peer connection library, Crust (standing for "Connected" "Rust").

How do you ensure all the nodes of an ever-morphing P2P network get and stay connected, even past firewalls and routers? How do you do it when most nodes are being run by non-technical people using their spare computer resources?

The demands are high. Will Crust be up to the job?

Music

Music for this episode: Safe Crossroads Beta, an original piece composed and performed by Nicholas Koteskey of Two Faced Heroes

Links

Medium article -- "SAFE-Fleming: Our Next Major Milestone"

MaidSafe Dev Update release of PARSEC

SAFE Crossroads #43, PARSEC - Efficient, Provable Consensus Has Arrived, with Pierre Chevalier

SAFE Crossroads #44, PARSEC Consensus Code Release, with Bart…'omiej Kami…"ski

SAFE Crossroads subscription links

from The Let's Talk Bitcoin Network https://ift.tt/2Prvm4z

What Bitcoin Did #42 Crypto Custody With Jeremy Welch & Alena Vranova

'œBitcoin does form the dominant position, it has the most hash power, it is the currency in terms of design, decentralisation, or ability for governments or corporate actors to control it, it is the strongest, therefor everything relies on Bitcoin's survival.'

'" Jeremy Welch

Interview location: Skype

Interview date: Saturday 27th October

Company: Casa

Role: Founder (Jeremy Welch), Strategy (Alena Vranova)

As the value of Bitcoin and Cryptocurrencies increase, custody has become an increasingly important and sophisticated part of self-sovereignty. The freedom and ease at which cryptocurrencies can be transferred also makes them a honeypot for hackers, coupled with immutable records, there is little recourse should your funds be stolen.

People hold their cryptocurrencies in a variety of wallets, from paper to hardware but these still expose vulnerabilities. From lost seed phrases to personal attacks, there is a demand in the market for more sophisticated custody solutions, and Casa is leading the way in developing the space.

With their central three-of-five management solution, Casa has targeted those with significant portfolios, but with the release of their Bitcoin full node and lightning node they are opening up options to more customers.

In this interview, I talk with Casa founder, Jeremy Welch and strategy lead, Alena Vranova (previously Trezor) about how the Casa solution works, the challenges of managing custody and why design is central to everything they do.

This episode is also on:

Listen to more What Bitcoin Did episodes

from The Let's Talk Bitcoin Network https://ift.tt/2SumY2I

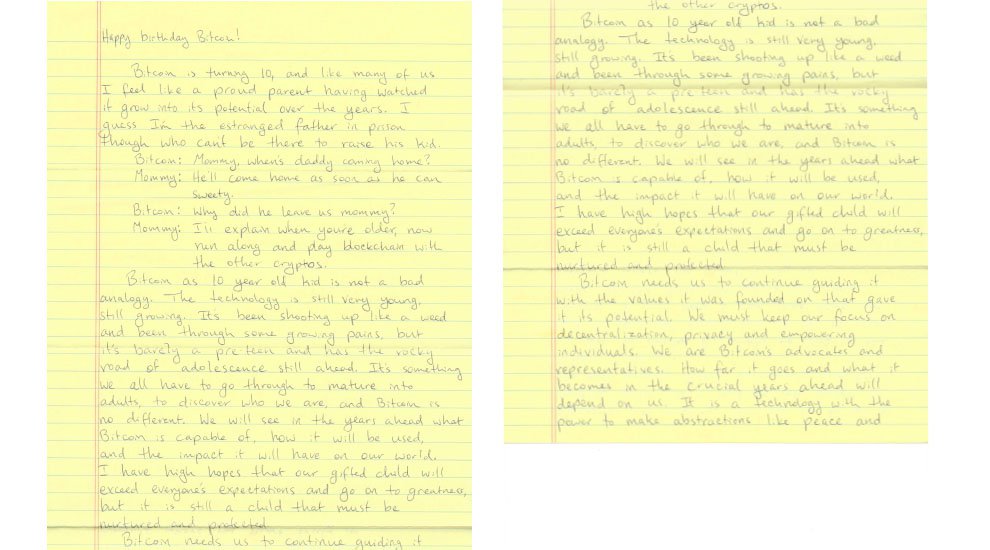

Happy Birthday, Bitcoin! A Letter From Ross Ulbricht

Happy Birthday, Bitcoin!

Bitcoin is turning ten, and like many of us, I feel like a proud parent, having watched it grow into its potential over the years. I guess I’m the estranged father in prison though, who can’t be there to help raise his kid.

Bitcoin: Mommy, when’s Daddy coming home?

Mommy: He’ll come home as soon as he can, sweetie.

Bitcoin: Why did he leave us, Mommy?

Mommy: I’ll explain when you’re older. Now run along and play blockchain with the other cryptos.

Bitcoin as a 10-year-old kid is not a bad analogy. The technology is still very young, still growing. It’s been shooting up like a weed and been through some growing pains, but it’s barely a pre-teen and has the rocky road of adolescence still ahead. It’s something we all have to go through to mature into adults, to discover who we are, and Bitcoin is no different.

We will see in the years ahead what Bitcoin is capable of, how it will be used, and the impact it will have on our world. I have high hopes that our gifted child will exceed everyone’s expectations and go on to greatness, but it is still a child that must be nurtured and protected.

Bitcoin needs us to continue guiding it with the values it was founded on, that gave it its potential. We must keep our focus on decentralization, privacy and empowering individuals. We are Bitcoin’s advocates and representatives. How far it goes and what it becomes in the crucial years ahead will depend on us. It is a technology with the power to make abstractions like peace and equality into reality. But it’s up to us to embody such ideals and be role models for the ever-growing Bitcoin community and for Bitcoin itself.

I’m so excited for what’s to come in the next ten years, for Bitcoin and all of its crypto cousins. I just hope I can come home and make up for these lost years and show everyone where my heart truly is.

This is a guest post by Ross Ulbricht. It was shared, with permission, with Bitcoin Magazine by Ross's mother, Lyn Ulbricht. To learn more about Ross, sign his petition for clemency, and support the campaign to free him, please visit freeross.org. Follow @free_ross, @RealRossU and the #freeross hashtag on Twitter. Visit Free Ross on Facebook and freerossulbricht on Instagram.

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2Sr0ujf

Bitcoin Price Analysis: Weekly Consolidation Hints Toward Sustained Breakout

Another week has passed as bitcoin continues to coil in a tighter and tighter consolidation. Both price and volume continue to consolidate as bitcoin decides where the next major move will be. A trend of higher lows and lower highs shows a balance of both supply and demand, but ultimately one will win out:

Figure 1: BTC-USD, Daily Candles, Macro Consolidation

Figure 1: BTC-USD, Daily Candles, Macro Consolidation

To gain a perspective of *just* how tightly wound the market is, a great tool analysts often use are Bollinger Bands (bbands). Bbands are a visual representation of forecasted volatility. If the bands are squeezing, there is a forecast for increased volatility in the future. Conversely, if the bands have already expanded and are beginning to round/bulge, there is a forecast for decreased volatility. In our case, on the weekly candles, the bands are squeezing tighter than they have in several years:

Figure 2: BTC-USD, Weekly Candles, Bollinger Band Squeeze

Figure 2: BTC-USD, Weekly Candles, Bollinger Band Squeeze

During the bull run, we could see a very clear trend of support being found on the bband midline for several years. However, at the beginning of our bear market, the midline has continuously proven itself to become resistant to every single rally over the last few months. However, as the price begins to consolidate further and further, the midline has drawn itself within striking distance, while the price trend has established a series of higher lows.

Even though a breakout has yet to happen, there are some early signs we can keep an eye out for, using the weekly Bollinger bands. I believe this next move will be a strong, sustained move that will paint the course of the market for months to come.

It’s very easy to get lost in the weeds while trading bitcoin because it is so volatile on low timeframes, but if you look at the bigger picture on daily and weekly candles, we can see the strength of the trend.

One early sign of a directional breakout is when the bbands begin to expand again. As I stated earlier, bbands are a visual representation of consolidation and can forecast volatility. If the bbands begin to expand, that is an indication that the volatility has chosen a direction and will likely continue in that direction until the bbands round/bulge — thus indicating a forecast for decreased volatility until it consolidates once again.

An early sign of a bullish trend reversal will be on the close of the weekly candle. If bitcoin can manage to close above the weekly midline, that will be a sign that we have broken resistance.

However, it’s important to note that just because we close above the midline doesn’t mean we *must* continue. The next candle (the one following the candle close above the midline) will give us more information. If we can establish two consecutive candles closing above the weekly midline, this will be a definite change of character for our trend as we have yet to see two consecutive closes above the midline:

Figure 3: BTC-USD, Weekly Candles, BBands Midline Rejections

Figure 3: BTC-USD, Weekly Candles, BBands Midline Rejections

Summary:

- Bitcoin continues to wind tighter and tighter as both price and volume consolidate in a sideways fashion with both higher lows and lower highs.

- On a macro scale, the consolidation can be visualized using weekly candle Bollinger Band trend. We are currently the most consolidated the market has been in several years and the breakout of this consolidation with undoubtedly be a strong, sustained move..

- Early signs of a breakout direction will be found with the BBand trend on the weekly candles. If the weekly candles can manage to close above midline of the BBands and, most importantly, find support, this will be a strong sign of a change of market character on a macro scale.

Trading and investing in digital assets like bitcoin and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTC Media related sites do not necessarily reflect the opinion of BTC Media and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2zft3HA

Standardized Specifications for Enterprise Version of Ethereum Announced

On October 29, 2018, the Enterprise Ethereum Alliance (EEA) announced in Prague at DevCon 4 two new software specifications that will help businesses standardize future code developments on an enterprise version of the Ethereum blockchain.

The first specification, Client Specification V2, defines the implementation requirements for Enterprise Ethereum clients, including interfaces to the external-facing components of Enterprise Ethereum and how they are intended to be used.

The standardization of performance, permissioning and privacy demands of enterprise deployments are viewed as a necessary step by the EEA in order to help the growing number of vendors developing Ethereum clients to ensure that different clients can communicate with each other and all reliably work on an enterprise Ethereum network.

EEA Executive Director Ron Resnick stated that “using the EEA Specification, Ethereum developers can write code that enables interoperability, thus motivating enterprise customers to select EEA specification-based solutions over proprietary offerings”. It should be noted that, while Ethereum has been basis for the majority of enterprise blockchain projects, 2018 has also seen developments using Cardano, EOS, QTUM and TRON, among others.

Aside from digital currency, enterprise or platform tokenization remains a hotbed for blockchain-based startups, with the vast majority of those needing an ecosystem where users can change the software they use to interact with a running blockchain, disambiguating the need for single-vendor support.

The second specification, Off-Chain Trusted Compute Specification V0.5, specifies enabling APIs that support private transactions, allowing offloads for compute intensive processing and permitting attested oracles. The EEA believes these objectives can be achieved by executing some parts of a blockchain transaction off the main chain in an off-chain trusted compute. The EEA currently endorses three types of trusted compute for this specification including a trusted execution environment, zero knowledge proofs and trusted multi-party compute.

Both specifications were lauded by Brian Behlendorf, executive director of Hyperledger, who lent his support to the announcements. The EEA and Hyperledger joined each other’s organizations as associate members on October 1, 2018.

Behlendorf stated, “We are pleased to see the EEA reach and release its V2 and Off-Chain Trusted Compute V.05 specifications. Both organizations believe standards, specifications and certification all help with the adoption of enterprise blockchain technologies by helping customers commit to implementations with confidence …”

The new specifications are backed by the EEA’s 500+ global membership, notably including banks like Santander and J.P. Morgan Chase; blockchain startups like blk.io; and traditional tech companies like Accenture, Intel and Microsoft.

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2ESoMjo

Distributed Dialogues: Political Censorship in China

On the latest episode of Season 2 of Distributed Dialogues, the hosts took a deep dive into the state of political repression in the People’s Republic of China. Interviewing experts and dissidents at the Oslo Freedom Festival, this thorough examination of Chinese political life combines insight and research with the real, lived experiences of people in the nation.

The podcast episode compared two people’s interactions with the state machines of China, one of whom was a U.S. citizen working as a journalist in China, the other a Chinese dissident made to flee his country. The journalist, Megha Rajagopalan, claimed that despite Western conceptions of Chinese political life, most citizens are “not concerned about the lack of freedom of speech.”

Technologies with the power to harm human freedoms are developed and deployed in countries with a strong emphasis on protecting these freedoms, but then they are “exported to other parts of the world where things like the rule of law and privacy rights aren’t very developed, with disastrous consequences.”

To showcase some of these consequences, this experience with modern China is intercut with the life of Fang Zheng, a promising Chinese athlete who was run over by a tank and lost both of his legs in the Tiananmen Square protests. Ever since then, his desire to represent his country as an international paralympic athlete has been subverted, and the government hounded him with more and more sophisticated methods over the years.

The episode serves as a documentary on the state organs of Chinese political repression, a well-researched examination into the context and effects of this ossified state power. However, the episode is not entirely bleak, as it also involves a look into how blockchain technology can evade China’s Great Firewall.

Justin Hunter, the founder of Graphite, talks about his censorship-resistant decentralized information storage, that can allow citizens to keep data without any government holding the ability to subpoena. A small measure at a glance, the very existence of information outside of government control is still a revolutionary act.

Topics in Distributed Dialogues Season 2 will continue to address human rights violations around the world and to bring in a number of experts who will describe these offences in stark detail. To listen to the full episode, as well as other episodes as they become available, visit the LTB Network.

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2JroKOa

Crypto Platform Coinbase Secures $300 Million in Series E Funding Round

Popular cryptocurrency exchange Coinbase has raised a fresh $300 million in a Series E financing round, bringing the company valuation to $8 billion.

Coinbase plans to use the funding to "accelerate the adoption of cryptocurrencies," as it plans to remain the "entry-point into crypto" for millions of investors, according to a published blog post.

The new investment round was led by investment firm Tiger Global with Y Combinator Continuity and Andreessen Horowitz, with others participating. In August 2017, Coinbase was valued at $1.6 billion, after receiving a $100 million from a Series D round led by Institutional Venture Partners investors (IVP).

Rumors of the funding had turned up in early October with Mike Novogratz, the CEO at cryptocurrency-focused merchant bank Galaxy Digital, arguing that the rumors added legitimacy to the cryptocurrency market.

“Here’s the poster child of the crypto space worth $8 billion — that’s a real company, and Tiger’s not a flake of an investor. These are smart, savvy guys,” he had stated at a finance conference, at the time.

“We see hundreds of cryptocurrencies that could be added to our platform today, and we will lay the groundwork to support thousands in the future,” Coinbase Chief Operating Officer Asiff Hirji remarked in the post.

It will also build its infrastructure to support regulated, fiat-crypto trading across the world, such as the launch of British pound sterling (GBP) trading pairs on Coinbase Pro and Prime.

The digital asset platform also plans to focus on “utility applications” for cryptos such as the launch of its USDC stablecoin, fully collateralized by the U.S. dollar and supported by Coinbase and blockchain firm Circle.

Based on a Fortune report, Coinbase has been mostly profitable, but the slump in crypto prices has affected trading volumes on exchanges across the board. Reduced trading volumes equate to reduced fees, which has driven the company to search for alternative sources of revenue.

Flush with cash, the platform will have its eyes on the custodial fees from institutional investors whose cryptocurrencies are kept with the digital asset platform. The platform also announced the addition of a wide range of crypto assets for its custodial services in August 2018 and the launch of a suite of tools and services that institutional investors can rely on when trading crypto.

“We see Coinbase’s growth as validation that the ecosystem will only continue to grow in size, influence, and impact — ultimately ushering in a more open financial system for the world,” Hirji concluded.

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2EV53Q1

Bytom Is Connecting Physical and Digital Assets - [BTC Media Sponsor]

Assets of all stripes have long been recognized for their value in building wealth, paying debts and meeting both short- and long-term commitments. But now, with the exponential growth of computing power and big data, the value of strictly digital assets has all but eclipsed the traditional physical assets that were long the cornerstone of personal wealth.

As such, there is a growing need for projects that can connect the worlds of traditional physical assets and cutting-edge digital ones, thus providing the best of both worlds.

A key player in this movement to move real-world assets into the digital world is a project known as Bytom. With an eye on rapid advancements taking place in the world of blockchain technology and artificial intelligence, this nearly 2-year-old project aspires to become the collision point between the old and new school.

Bytom is a blockchain protocol of multiple byte assets that serves as an engine for the exchange and interaction of real-world assets. Its target market includes blockchain industry insiders and enthusiasts, big data and AI industry stakeholders and institutions and individuals seeking to build financial and digital asset applications.

Launched in January 2017, Bytom was conceived by Chang Jia, creator of 8btc, and Duan Xinxing, former vice president of OKCoin. The Bytom Foundation is located in Singapore, a country ripe with favorable laws for blockchain development. This factor plays a key role in the accelerated growth of Bytom’s ecosystem.

Congruent with its broader aims, Bytom seeks to address a number of key compliance issues around linking digital assets with physical assets by aggressively improving and optimizing the underlying technology that drives this process.

The Bytom blockchain consists of three types of asset categories for exchange:

- Income assets, including nonperforming assets, fixed local government investments and homestay properties

- Equity assets, which encompass equity of nonlisted companies and equity of private funds

- Securitized assets like debts and automobile loans

The Bytom protocol allows these assets to be tradable on-chain, while eliminating middlemen who are traditionally involved in asset transfers and recordkeeping. This has led to faster transactions and lower costs. Moreover, the blockchain allows for greater security for these assets than would be achieved if they were with a third-party organization.

Users have the ability to create asset-backed securities on the Bytom blockchain through the use of smart contracts, allowing them to register and tokenize their assets. The platform can also be utilized for fundraising or initial coin offering (ICO) campaigns.

The Bytom Blockchain and Token

The Bytom blockchain protocol is an interactive protocol of multiple byte assets. Its native token, known as “BTM,” is used as a transaction fee for asset trading, income asset dividends and for asset issuance deposits. These coins can be stored in Bytom’s official wallet, which is available for download on Windows, Linux and macOS.

With the maximum number of Bytom tokens set at 2.1 billion, over 1 billion BTM coins are already in circulation. These coins can be purchased with other cryptocurrencies on several exchanges, such as RightBTC, Huobi, OKEx, KuCoin and Bibox.

Bytom finished its token sale in June, 2017. Thirty percent of the total supply was distributed during the ICO, with another 20 percent reserved for the Bytom Foundation. Ten percent was set aside for business development, 7 percent for private equity investors and 33 percent for mining efforts.

Strategic Milestones and the Path Forward

The Bytom mainnet was officially launched on April 24, 2018. In June of 2018, a token swap of ERC-20 Bytom tokens for the native Bytom coins took place across several exchanges. Bytom then released its smart contract functionality in late June.

Amid this flurry of progress, a partnership was formed with East Lake Big Data Asset Exchange, an organization involved in delivering big data solutions for Chinese government agencies. East Lake is collaborating with Bytom to bring new innovations to blockchain platforms and data assets trading.

And, in a practical use case, Bytom facilitated the world’s first cargo shipment with BTM as online payment in conjunction with SeaRates, the oldest resource dedicated to online logistics. By way of this collaborative endeavor, a shipment from China to South Korea was successfully executed through the use of BTM.

SeaRates now utilizes Bytom to execute transactions with precision and efficiency. As a result, BTM has the distinction of being the only cryptocurrency supported by SeaRates for online payments tied to logistics and international trade.

“The launch of Bytom comes from a real need in the community,” said CEO Duan Xinxing. “8btc was one of the earliest cryptocurrency and blockchain communities and forums. Many early writers and audiences of 8btc have become pioneers and leaders in this industry now. But despite having developed various successful public chains, alliance chains and private chains, they encountered the same problem, that is, assets and interests can only be operated on separate chains and cannot interact with each other, let alone interact with traditional assets in the real world.”

Xinxing added that, in order to realize the interaction between different digital assets in the atomic byte worlds, Chang Jia and he decided to launch Bytom.

“First, we want to optimize the underlying technology, in order to ensure a more stable operation of Bytom’s mainnet,” he said. “Second, we’re aiming to create a better support mechanism for developers through a more convenient smart contract and programming language support. Finally, our hope is to expand the developer community and the business cooperation community.”

Note: Trading and investing in digital assets is speculative and can be high risk. Based on the shifting business and regulatory environment of such a new industry, this content should not be considered investment or legal advice.

This promoted article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2DbmLgp

Telefónica and Rivetz Add Civic’s Identity Verification for Mobile Users

Civic has entered into a tripartite agreement with cybersecurity protection solution company, Rivetz, and Telefónica's cybersecurity unit, ElevenPaths, to provide secure identity verification that incorporates added hardware protections for mobile users.

With presence in five countries, Civic uses blockchain technology to secure and protect the transfer of personal information, while allowing people to decide how they share their information.

In correspondence with Bitcoin Magazine, Steven Sprague, CEO of Rivetz, called Civic's integration into the partnership as a "pivotal step toward providing the digital identity we need in today’s world."

In May 2018, Spanish telecom giant Telefónica partnered with Rivetz to develop decentralized security solutions for mobile users aimed at improving cybersecurity controls and protections for secure messaging and cryptocurrency wallets.

Rivetz's security solutions will leverage the Trusted Execution Environment (TEE), a hardware vault built into mobile phones for enhanced security. These solutions will be built into smartphones and supplemented with a secured Subscriber Identity Module (SIM), provided by Telefónica. The intention is to secure the private keys of users, even if the operating system is tampered with or infected by malware.

Civic's inclusion will make it possible for Telefónica's users to verify their identity in real time and separate locally stored personal information from the private key needed to sign transactions on the blockchain. Rather than having all details stored locally in one place, on the Civic App, Civic will store the private keys in the TEE, provided by Rivetz. The user's personal information will remain in the Civic App, which is protected by biometrics and high-level encryption.

CEO and Co-Founder of Civic Vinny Lingham sees the partnership as “a massive step.”

“Blockchain technology is transforming the way companies approach privacy and security,” he said to Bitcoin Magazine. “Our partnership with Rivetz and Telefónica is a reflection of that transformation, ensuring that digital identity and mobile security solutions go hand-in-hand.”

Lingham added, “As identity information is increasingly vulnerable, we’re working with like-minded companies to create the most effective, most secure identity solutions that protect people’s privacy, without requiring their data to be collected and stored.”

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2Px0n71

BlockFi Announces Global Expansion of Its Crypto-Backed Loan Services

Galaxy Capital–backed BlockFiis taking its loan services to the global stage.

According to a statement shared with Bitcoin Magazine, the platform is expanding its services to an international audience. This expansion will add to its offerings in 46 states of the United States, something that required “quite a bit of work,” according to CEO Zac Prince

“There were a few things we need to do, primarily in regards to lending licenses at the state level, which has gone really well. So we’re now live in 46 states in the U.S., so it felt like it was the right time to start shifting our efforts to international expansion,” he continued to say in an interview with Bitcoin Magazine..

BlockFi states that the global services are available “in accordance with U.S. international business regulations.” Prince said that the company “definitely had to do a few things on the compliance side” to get to this point, explaining that the services for businesses and retail investors are “open to any country other than countries that are on the U.S. sanctions list,” while for reasons Prince did not elaborate on, retail investors in a handful of other restricted countries will also be barred from the services.

Founded in 2017, BlockFi is backed by Mike Novogratz’s Galaxy Capital to the tune of $52.5 million, and it has also attracted venture capital from ConsenSys Ventures and PJC.

The platform allows users to take out crypto-collateralized loans. Each loan has a minimum and maximum threshold of $2,000 and $10,000,000 respectively, and interest rates on these loans range from 8 to 12 percent, depending on the loan. To withdraw a loan, users can send either bitcoin, ether, litecoin or Gemini USD (GUSD) to the company, which will then issue the corresponding loan in USD.

Prince said that an expansion of this sort had been on BlockFi’s radar for some time; until recently, they merely lacked the resources and manpower to execute the vision. Notably, he said that stablecoins like GUSD have made things a little easier.

“It was largely a function of just focus and resources. We always knew that we wanted to do it. One of the things that accelerated it a bit was the dollar-backed tokens by Gemini and Circle. These make it a lot easier for us to facilitate payment, both in terms of funding the loan to international borrowers and also in terms of receiving payments — by not having to go through traditional banking rails.”

He explained that it allows them to send GUSD in the place of actual USD any day of the week if their clients want funds when banks are closed. It also eases foreign payments. Circumventing traditional banking structures, BlockFi doesn’t have to worry about remittance fees and currency conversions. For foreign individuals who want their loans in USD, he explained, a tokenized USD makes all the difference.

“With GUSD we’re able to send it faster, cheaper and 24/7. And when it gets to our clients it’s still a USD, even if tokenized,” he said.

Prince also said that BlockFi uses Gemini’s custody services for cold storage, asset management and even insurance, the last feature of which is newly FDIC-guaranteed.

BlockFi recently added support for GUSD alongside litecoin, and Prince revealed that the platform will soon integrate USD Coin (USDC), a fiat-collateralized stablecoin developed by Circle and Coinbase, and bitcoin cash, as well.

“A Way to Deliver Low-Cost Credit”

The move for global accessibility follows a surge of international interest in the platform, as BlockFi reports that in Q3 2018, 50 percent of its website visits came from outside the U.S., and one-third of its applications came from non-U.S. residents.

Coinciding with the expansion, BlockFi has outfitted its support team to accommodate Spanish- and Mandarin-speaking users. Prince further explained that these language choices are in direct response to the user attention the platform received in Q3 from Spanish- and Mandarin-speaking areas.

They’re also in response to the thriving cryptocurrency communities that overlap with the unbanked populations in countries like those in Latin America, wherein citizens have turned to crypto as a hedge against hyperinflated fiat currencies, a remittance option and private money.

“Countries like Argentina and Mexico — we’ve also seen a lot of application volume from Brazil, though they speak Portuguese — where there’s a lot of people who own crypto and where there’s a strong use case for holding assets like bitcoin we also want our service to be available in those markets,” Prince said.

He went on to state that in these countries, the interest rates for loans are often unsustainable for the average citizen. With access to services like BlockFi, however, he said they can withdraw loans at “basically the same rates as the U.S.,” something that frees up lines of credit for an otherwise loan-deprived population.

“We’re using bitcoin as a way to deliver low cost credit in markets where it hasn’t been before.”

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2zhyQfC

Storj Launches Version 3 of Its Decentralized Cloud Storage Platform

On October 30, 2018, Storj Labs released a public alpha for their version 3 (V3) platform –– enabling developers and companies to test their decentralized cloud storage solution. The team also shared an updated white paper featuring their latest research on decentralized and distributed systems in cloud storage.

Decentralized Cloud Storage Refresher

Decentralized cloud storage solutions like Storj enable users to securely store their data on decentralized clouds utilizing peer-to-peer networks instead of storing their information on the servers of large corporations. This model works like an Airbnb for data; users with extra hard drive space can rent out their space as a place for other users to store their information.

The decentralized cloud storage model has several benefits over centralized cloud storage:

- “Trustless” security: Users are the only ones who have access to their private keys, and are, therefore, the only ones who can access their files. Decentralized storage providers or hackers can’t access a user’s private information.

- Lightning-fast networks: In centralized cloud storage models, download speeds are contingent on a centralized data center. But, because decentralized networks are shared, download speeds are shared too. The more users on the network, the faster the network.

- Open-market for data storage: By creating an open market for storage, decentralized storage companies can provide lower rates than those of incumbents such as Amazon, Microsoft and Google.

Storj Public Alpha

Starting today, the Storj public alpha allows developers and companies to access and build decentralized cloud storage applications by downloading and running the V3 test network on their local hardware.

With their latest update, the Storj team aims to set themselves apart from competitor projects like Filecoin, Sia and MaidSafe, and position themselves as leaders in the decentralized cloud storage space.

In an interview with Bitcoin Magazine, Storj Co-Founder and CSO Shawn Wilkinson shared, “The biggest reason I think we are the leaders in decentralized cloud storage is because of our experience and track record in the market. We are now on the third iteration of our network, while others haven’t conducted their initial launch after several years in development. Not only is our early team experienced, we’ve also hired new individuals with some of the best experience in the industry.”

Wilkinson also noted that the Storj team hopes to drive practical adoption of decentralized cloud storage by making it simple to rewire existing cloud storage solutions with Storj’s decentralized cloud storage platform.

For example, Storj V3 is built to be Amazon S3 compatible, meaning that integrating Storj into applications that currently use centralized cloud storage generally requires changing only a few lines of code and a few minutes of time.

Storj Partners

Decentralized cloud storage could be helpful for a variety of use cases.

“Any application or company that is generating data outside of the public cloud, or has large file sizes, would be a perfect client. This is because cloud providers will often charge egress fees to transfer your data off the network. Also, because of our distributed nature, our platform is most cost effective for large files. However we work great for anyone in need of cloud storage and can lower costs for most storage use-cases,” shared Wilkinson.

Current Storj V3 partners include Couchbase, MongoDB, FileZilla, InfluxData, Kafka and Blocknify.

"We chose Storj because we shared similar values of privacy via end to end encryption and creating resilience through decentralization,” said Chris Cowles, co-founder and CEO at Blocknify, a Docusign competitor that leverages blockchain technology. “Because Storj uses S3 standard of integration, implementing Storj is familiar and easy.”

Key Storj V3 Developments

The updated Storj white paper highlights the team’s learnings from the V2 network, addresses design constraints and security deliberations, defines the Storj platform’s relationship with blockchain technology, and addresses the team’s key goals moving forward.

Scalability

While Storj V2 was only capable of smoothly scaling to 100 petabytes of data, V3 aims to handle exabytes (and more) of data storage by utilizing horizontal scaling to contend against incumbent cloud storage solutions, and it aims to update this alpha so that node operators can share their excess storage capacity with the network in early 2019.

Architecture

Functions of the Storj network have been decoupled into separate components to allow developers to make changes to parts of the system without impacting the whole. The team hopes this will lead to faster development and greater open-source contribution.

Data Uploading

When files were uploaded in Storj V2, the data would be encrypted, sharded (split into different pieces), replicated and distributed. Wilkinson explained that in V3, “Files are divided into segments, which are then divided into stripes. After, stripes are organized into erasure shares and uploaded.” Storj claims that striping enables video streaming and buffering functionality similar to the YouTube experience, even if using 4K settings.

At a high level, Erasure codes allow the receiver to recover all data from any portion of the data. For example, erasure codes are used by satellites when they transmit data because they assume some data will not reach its final destination.

Storj’s decision to utilize erasure codes to deliver file resiliency is unlike most decentralized cloud storage providers, which choose replication to deliver reliability in case storage nodes fail.

In an interview with Bitcoin Magazine, JT Olio, Storj Labs director of engineering, explained the reasoning for Storj’s transition to erasure codes:

“Purely using erasure codes for resiliency is much more efficient in terms of the required storage capacity and bandwidth used to meet service level agreements. We found that our new architecture is able to achieve AWS-level resiliency with an expansion factor of 2-3, meaning for every gigabyte of data stored, we use 2-3 gigabytes of storage capacity on the network. Systems that use replication to achieve the same resiliency would require 10-16 gigabytes of storage capacity per gigabyte of data stored. In our preliminary tests, compared to our previous network (which predominantly used replication), we have greatly improved file durability while cutting the expansion factor in half.”

Revenue Sharing

Storj launched a program to share 10 percent of every dollar earned from clients that Storj Partners introduced to the network. The team hopes this will help open-source companies generate revenue when their users store data in the cloud.

This article originally appeared on Bitcoin Magazine.

from Bitcoin Magazine https://ift.tt/2Ptl6so

Two themes to balance risk and return in this market: Nilesh Shah, Kotak AMC

Here are Mayuresh Joshi’s top 3 IT picks

Dipan Mehta is bullish on these 5 sectors, here’s why

Good time to raise allocation to equity: Nilesh Shetty, Quantum MF

Portfolio buyouts from NBFCs to give positive push to PSBs in Q3: Raj Kiran Rai G, Union Bank of India

Consumption growth on track but the pattern has changed: Arvind Singhal, Technopak

Too many discounts may be spoiling retail sustainability: Harish Bijoor

Ethereum Price Analysis: ETH/USD’s Previous Support Now Resistance

Key Highlights

- ETH price started a short term upside correction and moved above $196 against the US Dollar.

- There is a key connecting bearish trend line formed with resistance at $198 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair recently tested the previous support at $198, which acted as a solid resistance.

Ethereum price is slowly recovering against the US Dollar and bitcoin. However, ETH/USD is likely to face a lot of hurdles near $198 and 100 hourly SMA.

Ethereum Price Analysis

Yesterday, there was a major downside move below the $198 support in ETH price against the US Dollar. The ETH/USD pair declined below the $195 level and traded towards the $190 level. It traded as low as $190.91 settled below the 100 hourly simple moving average. Later, the price started an upside correction and traded above the $194 and $195 levels.

Buyers also pushed the price above the 23.6% Fib retracement level of the last drop from the $204 swing high to $190 swing low. The price also moved above the $196 level, but it faced a strong resistance near the $198 level. The stated $198 level was a support earlier and now it is acting as a resistance along with the 100 hourly simple moving average. Besides, the 50% Fib retracement level of the last drop from the $204 swing high to $190 swing low is also near the $198 level. More importantly, there is a key connecting bearish trend line formed with resistance at $198 on the hourly chart of ETH/USD.

Looking at the chart, ETH price is facing a tough challenge near the $198 and $199 levels. As long as the price is below these resistances, it could resume its decline below $196. On the downside, the $190 level is a solid support followed by the $185 level.

Hourly MACD – The MACD is currently placed in the bullish zone.

Hourly RSI – The RSI is back above the 50 level.

Major Support Level – $190

Major Resistance Level – $198

The post Ethereum Price Analysis: ETH/USD’s Previous Support Now Resistance appeared first on NewsBTC.

from NewsBTC https://ift.tt/2ETtIo8

Checking Crypto Prices on Your Mac? Watch Out for Malware

A popular cryptocurrency price ticker available to download for Apple’s Mac computer lineup includes malware that could expose investors to cyber criminals seeking to steal a user’s cryptocurrency holdings.

CoinTicker Mac App Leaves Investors Exposed to Malware

Cyber security firm Malwarebytes Labs, best known for their antivirus and malware monitoring and removal software, has posted a public service announcement on their official blog, warning Mac users of a cryptocurrency price ticker app available to download on the Apple App Store for Mac that leaves users exposed to two potential backdoors for cyber criminals to access.

The app, called CoinTicker, adds a handy price ticker in the status bar at the top of a Mac user’s screen, alongside important information such as the time, date, and wifi connection. The app can be set to show real-time price data for Bitcoin (BTC) and dozens of other altcoins such as Basic Attention Token (BAT) and Monero (XMR), pulled directly from popular exchanges like Bitfinex, Binance, and many more.

Malwarebytes Labs reports that a forum user had discovered that after the app was installed, CoinTicker then installs two open-source backdoors by the name of EvilOSX – in reference to Mac OSX – and EggShell. The two “broad-spectrum backdoors” aren’t malicious on their own, but Malwarebytes Labs believes the access would be used to steal a user’s crypto assets.

“Since the malware is distributed through a cryptocurrency app, however, it seems likely that the malware is meant to gain access to users’ cryptocurrency wallets for the purpose of stealing coins,” the company speculated.

While Apple is known to have a strict process for vetting apps, CoinTicker is currently ranked 100th in Apple’s App Store list of finance-related apps and is putting Apple customers who invest in cryptocurrencies at a significant risk. The oft cited claim from Apple aficionados that their machines are immune to malware is weakening by the day.

How to Protect Yourself From Crypto-Malware

Cryptocurrency investors are already dealing with enough challenges, including a sometimes difficult-to-understand emerging technology, market uncertainty, and more. But among the most important issues for crypto investors to look out for, are related to malware and personal security.

There are two primary types of cryptocurrency malware users should be aware of: crypto-jacking malware used to mine for cryptocurrencies, and malware geared toward stealing a user’s cryptocurrencies. While crypto-jacking still poses a threat to users, it doesn’t put a user’s assets at risk. It instead hijacks computer resources to mine for cryptocurrencies, and can cause issues like computer slowdown, or cause programs to crash while the malware operates in the background. None of which is a serious threat.

However, it’s the crypto-stealing malware that either steals sensitive user data such as logins and passwords, or replaces crypto wallet addresses copied to a computer’s clipboard with a cyber criminal’s address, that investors need to be extra wary about.

Crypto investors are encouraged to do their own research into crypto-related security measures, however, a few simple steps can go a long way in keeping crypto assets safe:

- Only download apps, add-ons, or plug-ins from a trusted third-party.

- Ensure all system software and apps, add-ons, and plug-ins are updated regularly.

- Look out for any unusual computer slowdown after downloading a new program.

- Double- and triple-check crypto wallet addresses before sending.

- Regularly scan your computer using a reputable malware removal tool, such as the one provided by Malwarebytes Labs.

- Last but not least, never, ever disclose your crypto holdings publicly – it could make you a target.

Image from Shutterstock

The post Checking Crypto Prices on Your Mac? Watch Out for Malware appeared first on NewsBTC.

from NewsBTC https://ift.tt/2EW5GZB

Cryptocurrency Market Update: Birthday Bitcoin Stays Over $6,000 for a Year

FOMO Moments

Markets have found a new level for now; Dash, OmiseGO starting to recover, Revain dumping still.

Crypto markets seem to have found another plateau for the time being. Yesterday’s big dump stopped just above $200 billion total capitalization and markets have remained at that level today.

Bitcoin has found support above $6,300 for now and has stayed there for the past 24 hours remaining flat on the day. The bears are still dominating things so a further decline to $6,200 could be imminent. Ethereum has extended its losses and remains under $200 at $197 at the moment.

Altcoins are currently mixed which suggests that they have found another level and no further losses have occurred. In the top ten only Monero has managed to claw back anything, and that is only 1.2% to just over $100. The biggest loser is Cardano again as ADA slips closer to dropping out of the top ten.

The top twenty is also half green and half red but only marginally. Dash is currently making the best recovery with a 2.5% gain to $156. Still falling is VeChain with a further loss of 2.5% during the morning’s Asian trading session. Just outside this area of the chart at 21 is OmiseGO has also made nearly 4% back today.

There are no double figure fomo pumps right now but topping the top one hundred’s best performing altcoins at the time of writing is Chainlink and Pundi X bit gaining 6-8 percent on the day. PIVX has also regained 5% and Loom Network is not far behind.

Topping the red end of the top one hundred and the only altcoin with a double digit loss is Revain shedding 13% at the moment. Also getting beat up is Cryptonex, Dentacoin, Digitex Futures, and Revencoin all losing over 7% on the day.

Total market capitalization has held the level it fell to yesterday which is $203 billion. Trade volume is a lowly $10 billion and this appears to be its new channel for now. We are still in the depths of 2018’s yearlong crypto winter. Bitcoin’s dominance has remained over 54% for its birthday and aside from a couple of quick dips has remained over $6,000 for a year which is remarkable.

FOMO Moments is a section that takes a daily look at the top 20 altcoins during the current trading session and analyses the best performing ones, looking for trends and possible fundamentals.

The post Cryptocurrency Market Update: Birthday Bitcoin Stays Over $6,000 for a Year appeared first on NewsBTC.

from NewsBTC https://ift.tt/2Q8tOth

Bitcoin Cash Price Analysis: BCH/USD Recovery Facing Hurdles

Key Points

- Bitcoin cash price started a short term correction and moved above $420 against the US Dollar.

- There is an ascending channel in place with support at $415 on the hourly chart of the BCH/USD pair (data feed from Kraken).

- The pair recently tested the channel resistance and failed to break the $422-423 zone.

Bitcoin cash price remains in a bearish zone below $430 against the US Dollar. BCH/USD may correct further higher, but it is likely to find resistance near $425-430.

Bitcoin Cash Price Analysis

Yesterday, we saw a major downside move below the $430 support in bitcoin cash price against the US Dollar. The BCH/USD pair traded as low as $408 and settled below the 100 hourly simple moving average. Later, the price started a short term recovery and moved above the $415 level. It also managed to clear the 23.6% Fib retracement level of the recent drop from the $438 high to $408 low.

The upside move was positive as there was a spike above the $420 level. However, the price failed to surpass the $422-423 zone. There was also no test of the 50% Fib retracement level of the recent drop from the $438 high to $408 low. At the outset, there is an ascending channel in place with support at $415 on the hourly chart of the BCH/USD pair. The pair is currently moving lower towards the channel support at $415 where buyers could emerge. In the short term, it seems like the price may correct towards the $425 or $430 resistance levels.

Looking at the chart, BCH price remains in a downtrend as long as there is no close above $430. On the downside, the recent low at $408 is a decent support followed by the $400 handle.

Looking at the technical indicators:

Hourly MACD – The MACD for BCH/USD is slowly moving in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BCH/USD is now back above the 50 level.

Major Support Level – $415

Major Resistance Level – $425

The post Bitcoin Cash Price Analysis: BCH/USD Recovery Facing Hurdles appeared first on NewsBTC.

from NewsBTC https://ift.tt/2qickzf

Ron Paul Advocates for Cryptocurrencies to be Tax-Free While Criticizing US Fed

Ron Paul, the Austrian School economist and notable Libertarian who served as a US Representative for over ten years, is now advocating for a tax exemption on cryptocurrencies. He also noted that the issuance of a government-backed digital currency, as opposed to private or decentralized ones, could lead to a “Fed-created recession.”

Paul made these remarks in a recent blog post titled “Trump is Right, the Fed is Crazy,” where he not only criticized the central bank, but also supported cryptocurrencies, explaining that one way to end the “monetary madness” is to stop taxing cryptocurrencies.

He also noted that a so-called Fed-created recession could lead to the end of fiat currency, which is why they should support the use of non-state-backed fiat currencies, and that all cryptocurrency and precious metal-related transactions should be exempt from capital gains taxes.

“It is likely that the next Fed-created recession will come sooner rather than later. This could be the major catastrophe that leads to the end of fiat currency. The only way to avoid crisis is to force Congress to end our monetary madness. The first steps are passing the Audit the Fed bill, allowing people to use alternative currencies, and exempting all transactions in precious metals and cryptocurrencies from capital gains taxes and other taxes,” Paul explained.

On the unlikely chance that the government follows Paul’s suggestion and excludes cryptocurrencies from capital tax gains, it would be an incredibly positive development for the industry, as it would further legitimize the markets and encourage traditional investors to enter the markets due to the lack of taxes.

Ron Paul Has a Long-Established Record for Advocating for Cryptocurrencies

Paul has a long-established track record for being an advocate for cryptocurrency, and recently wrote extensively about it in a June post titled “The Dollar Dilemma, Where to From Here?” In this post, Paul notably explained that cryptocurrency, and gold, could play a serious role in restoring citizen’s confidence in currencies and could help re-establish economic order.

In this post, he explained that the markets will easily sort out whether or not cryptocurrencies or precious metals are the answer to a flawed financial system but added that the government’s intervention in the markets will act as the largest barrier.

“The marketplace is quite capable of sorting out the advantages and disadvantages of cryptocurrencies and precious metals. The biggest challenge will be to get the government out of the way to allow this choice,” Paul said.

He further explained that the world may one day see a monetary system based on a mixture of precious metals and cryptocurrencies, each posing certain advantages that account for the other’s disadvantages, saying that:

“It’s conceivable that cryptocurrencies, using blockchain technology, and a gold standard could exist together, rather than posing an either-or choice. Different currencies may be used for certain transactions for efficiency reasons…A combination of gold and crypto will prove to be a lot more achievable than getting people to adapt to a totally new concept of money.”

In 2013, someone created a cryptocurrency called RonPaulCoin to pay tribute to his Libertarian ideals that are often seen as being embodied by decentralized cryptocurrencies.

Featured image from Shutterstock

The post Ron Paul Advocates for Cryptocurrencies to be Tax-Free While Criticizing US Fed appeared first on NewsBTC.

from NewsBTC https://ift.tt/2PzFGaw

Ripple Price Analysis: XRP Volumes Dry Up as Monthly Losses Rise to 23 Percent

Even as traders and investors maintain a bullish outlook, XRP/USD monthly losses are high. Because of Oct 29 losses, we shall revert back to neutral, holding off trading now that our stops at 45 cents were hit on Monday. Encouragingly, the hype around Ripple’s achievement, XRP may find support at 40 cents and perhaps steer a comeback.

Latest Ripple News

Clearly, digital assets are not like stocks. The latter are more stable and react to prices—fast! Unlike stocks, XRP is a sought after assets. The coin became a talk in this space in late Sep when prices more than tripled before ecstatic buys came to a halt. Consequent correction did sober traders but by that time the market newfound trend was clear. It seemed to be a bullish quarter until now. A look at different crypto exchanges hint of drying volumes as Bitcoin dominance increase.

So far, there is literally no demand for XRP as it was the case during the mini-rally. Instead periphery coins as EOS, Monero and surprisingly Waltonchain are dominating Bithumb and other SE Asia exchanges. Surprisingly, this comes at a time when news of Ripple achievements is all over the web. In fact from recent XRP Markets Report, institutional demand for XRP is up 450 percent from Q2 while all other metrics are simply on an uptrend.

At the same time, more exchanges as XRP United are domiciling their pairs in XRP becoming direct beneficiaries of the platform’s speed, reliability and cost cuttings. While XRP investment avenues expand, Ripple is forging new relationships with corporations, payment processors and spearheads a Washington Lobbying Group advocating for reasonable crypto regulation.

XRP/USD Price Analysis

Weekly Chart

After dropping 23 percent in the last month, the XRP/USD pair is the biggest loser in the top 10. Regardless, bulls should remain steady in their position because even if prices are trudging, XRP/USD is trending well within our ideal reversal zone.

When we paste a simple Fibonacci retracement tool between Sep high low, it’s clear that prices are trending at levels where historically assets trend to resume trend. Therefore, despite the overall sentiment around altcoin momentum drop, XRP is solid and bullish. In fact XRP/USD is trending inside week ending Oct 22 and still inside the all important week ending Sep 23.

As such, unless there are drops below 35 cents-40 cents main support, our previous XRP/USD trade plan is still valid.

Daily Chart

In our previous XRP/USD price analysis, we had recommended traders to initiate long trades once prices rally above 55 cents or the 50 percent Fibonacci retracement level. But this appears to be a tall order. Instead it is likely that XRP/USD will drop below the 78.6 percent or the lower limit of our reversal zone at 40 cents as sellers pick up momentum.

In any case, bear momentum magnification could lead to reversal of week ending Sep 23 gains. But for now, we hold a neutral position with a cautious outlook. Should today close lower then we wait to see how XRP/USD pair react at 35 cents-40 cents main support.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

The post Ripple Price Analysis: XRP Volumes Dry Up as Monthly Losses Rise to 23 Percent appeared first on NewsBTC.

from NewsBTC https://ift.tt/2OgZ2N4

Cardano (ADA/USD) Shed 18 percent as Bear Momentum Pick up

At the face of bears, Cardano (ADA/USD) pair losses are steep. It’s down 18 percent in the last month as LTC/USD sink deeper into loss making territory despite market building announcements. This divergence between technical candlestick formation and fundamentals could temper prices. But first we need to see strong rejection of lower lows.

Let’s have a look at these charts:

EOS/USD Price Analysis

EOS Nation, a group of well-meaning developers drawn from different block producers shall vote today and decide on whether they shall release a tool, EOS Referendum that will make block producer voting easy.

The EOS referendum tool is nearing a beta release. During this time the community may experiment and UI providers can get up to speed. After the beta release we can expect real referenda and real change on the #EOS mainnet. https://t.co/ODT3xNSS0V

— EOS New York (@eosnewyork) October 26, 2018

This is part of the whole effort to improve EOSIO governance allowing users to stake tokens in a ballot like system. Expedition will be through a forum smart contract and a tallying system for casting and counting cast votes. The team shall avail a voting portal complete with documentation for easy voting once the tool is live.

Back to price and EOS is down five percent in the last week and pretty stable in the last day. Following Oct 29 meltdown, we were expecting prices to stabilize as the market re-calibrate. But, despite the slide, none of our trading conditions are live. Therefore, we shall retain a neutral stand until we see declines below $4.5 or rallies above $7 triggering a new wave of buy pressure aiming at $9. However, this should not stop aggressive traders from trading in the direction of least resistance. As such, selling at spot with stops at Oct 29 highs at $5.55 and first targets at $4 should be ideal.

LTC/USD Price Analysis

Thing is, LTC/USD pair is now trading below the main support and sell trigger line at $50. Despite expectations of higher highs following Oct 15 USDT debacle, sellers did step up leading to massive losses on Oct 29. Therefore, in a classic bear breakout trade, our trade conditions as laid out in previous LTC/USD price analysis is now live. Thanks to yesterday’s inactivity and LTC bulls’ failure to respond, we recommend shorting at spot with stops at Oct 29 highs at $52.

XLM/USD Price Analysis

The Stellar Network, through a medium post has announced their version of the Lightning Network called the Star Light. The off-chain solution is now in beta and users are guaranteed of fast and free settlements through their payment channels that allow funds to be locked up by the channel participants.

Participants can then execute their transactions off-chain while remaining safe and private. At the moment, the Star Light off-chain payment channel supports a two-party settlement. However, in days ahead the network plans to create Multi-hop payments between channels compatible with Bitcoin’s Lightning Network and Ripple’s InterLedger.

Following Oct 29 losses, we are back to neutral trading in line with our previous XLM/USD trade plan. This is so because while Oct 15 gains are yet to be reversed, a cautious approach would involve waiting for trend confirmation and that demand XLM surge above 25 cents. Conversely, complete Oct 15 gain reversal would push XLM back to within the 15 cents-20 cents limit marking our main support zone. This is why before any of this prints out, we recommend taking a neutral, safe stand in line with our last XLM/USD trade recommendations.

TRX/USD Price Analysis

Like the rest of the market, BTC drops amplify losses in some pairs like TRX/USD. It’s down eight percent in the last week and a bit stable in the daily chart despite yesterday’s draw-down. Now, going forward, we shall retain yesterday’s plan encouraging risk-off, aggressive traders to unload at spot with stops at Oct 29 highs at around 2.5 cents. First targets will be at the 2 cents mark and later Aug double bottom at 1.5 cents.

ADA/USD Price Analysis

Even with the release of Rust CLI, ADA losses are compounding and down seven percent in the last week. From a larger view, it seems the slide is just beginning because ADA/USD is down 20 percent. The result is a meltdown below 7 cents as sellers reverse Oct 15 gains hitting stops as a result. Because of yesterday’s development, aggressive traders can begin unloading the ADA/USD pair at spot with stops at Oct 29 breakout bar highs at 7.4 cents. Moderate targets are at 6 cents but losses beyond that open new Cardano ATLs.

Disclaimer: Views and opinions expressed are those of the author and aren’t investment advice. Trading of any form involves risk and so do your due diligence before making a trading decision.

The post Cardano (ADA/USD) Shed 18 percent as Bear Momentum Pick up appeared first on NewsBTC.

from NewsBTC https://ift.tt/2Jqa55P